My ultimate goal is to earn enough passive income off of my investments that I don’t have to work.

This year, I’ve been asking myself, how do I determine whether or not I should focus on developing a particular passive income stream?

I hope this article yields some insights, along with a framework that you can use to figure out if you should pursue a particular venture.

#1. The time cost of acquiring savings

Before you think about passive income, I think it makes the most sense to nail down the cost of acquiring savings. This is going to be different for each person.

For example, it might take you 1 year to save $5,000. It might take you two years. This number is important because it presents the EFFORT OVER TIME that’s required to amass a particular amount of money.

Rather than looking at $5,000 as a stack of dollar bills that you can use for X, Y, and Z, view it as a measurement in time. If it took you one year to save that amount with your income and expenses, then it represents one year’s worth of work.

In this example, which I’ll be using for the rest of the blog post, $5,000 = 1 year.

#2. The percentage ROI on your savings

Let’s take that $5,000 and assume that you are able to achieve a 10% annual return from that money.

Over your first year, you would earn an extra $500 or $41.66/month.

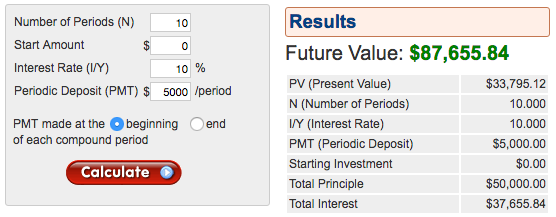

You can use a future value calculator to predict how much your investing will be worth over time.

Over the span of 10 years, if you saved $5,000 per year, your sum would be worth $87,655.84, assuming a 10% growth.

With that sum of money, you could earn $8,765.58 per year or $730.47 per month in income, assuming a 10% return.

Not bad, but remember it took ten years to be able to earn this amount passively from your money.

#3. The value of passive online income

Let’s just say I told you that YOU could earn an extra $100 per month in passive online income. For the sake of the argument, maybe it’s through advertisements on your blog or the sale of a digital product

$100 doesn’t seem like a lot, right? Wrong!

Remember, let’s measure money in terms of the TIME it takes to acquire that money.

It takes you one year to save $5,000.

An asset that produces $100 per month allows you to earn an extra $1,200 per year in passive income.

It would take you 25% of your work year to save this amount of income, or 3 full months. But you’re now doing it effortlessly.

Also, $100 per month doesn’t sound crazy, right?

BUT, it would require $12,000 in savings to generate this amount of passive income.

Also, it would take you about two years to save the $12,000 needed to generate this amount of passive income. When, maybe, it only takes one year to build up the product or website that generates $100/month.

Let’s take this example further. If you worked hard and built up a website that’s generating $420 per month on the side, you’d be adding an extra $5k per year to your savings pile, which for you, represents a FULL YEAR of working at your traditional job.

As you can see, even small amounts of passive income that you create online can make a big difference.

#4. Should you focus on a passive income stream?

It really comes down to point #1, your cost of saving money.

Let’s say it takes 12 months to develop a web asset into a passive income stream of $100/month.

If you’re saving $100,000 a year, the effort it takes to build up this passive income stream doesn’t make sense, because it would only take you 1.2% of your work year to save this income.

However if you’re saving $5,000 a year, I think it makes complete sense to focus on this type of passive income stream because it would represent 25% of your saving power.

If you’re only saving $2,000 per year, it would be 50% of your saving power.

Basically, in my mind, the less money you’re saving each year, the more sense it makes to get into the online business game, particularly as a part-time venture.

#5. Can you apply this strategy?

This is the thought framework I use to determine what items I should focus on when building my own passive income.

There are a few different variables that you’ll need to take into account, like the ROI on your savings, the taxes on your income, and your expenses.

I began to adopt this mindset because I used to think that an $100 per month in extra passive income was not worth working hard for. As you can see, it IS worth it.

The way I see it, every time you build an asset online that generates $100 per month, it’s basically like having generated $12,000 out of thin air (in terms of its earning power).